Welcome to the 101st edition of Methods of Prosperity! Last week, we hit a milestone with our 100th issue, and I’m thrilled to share this journey with you. This week, let’s explore the common traits that define the world’s wealthiest individuals.

John Arrillaga built his fortune on a singular focus. Buying real estate near Stanford University. In the process, he transformed Silicon Valley. Unlike typical tech billionaires, Arrillaga didn’t follow industry trends. He didn’t seek to “change the world.” He concentrated on a narrow “circle of competence.”

Arrillaga was born in 1937 in Inglewood, California, to a modest family. He worked various jobs to support himself through high school and university. Stanford gave him a basketball scholarship. After graduating, he desired to start a family. That’s why he quit basketball and got a job selling insurance. Which allowed him to save enough to start investing in real estate.

He transformed farmland into valuable office spaces, partnering with Richard Peery. Their company, Peery-Arrillaga, became Silicon Valley’s largest commercial real estate developers. They leased space to companies like Intel, Apple, and Google. Arrillaga’s strategic investments made him one of the area's largest landowners. His fortune reached an estimated $2.5 billion by 2020.

He was a significant benefactor to Stanford University and his local community. Arrillaga donated over $300 million, building numerous educational and public facilities. His legacy is not only his financial wealth. It’s his pivotal role in transforming Silicon Valley. From agricultural land into a global tech hub. John Arrillaga passed away on January 24, 2022, at the age of 84.

We’re improving quality of life at scale for hard working families.

Inveresta Holdings LLC is seeking capital partners, brokers, and motivated sellers. We don’t need more money. What we’re looking for is to trade up the investors we have for a better class of investor. Accredited investors only. You’re invited to secure your place on our waitlist now. You’ll receive details about our investment strategy.

ⓘ This is not an offer, solicitation of an offer, to buy or sell securities. Past performance is not an indication of future results. Investing involves risk and may result in partial or total loss. Prospective investors should carefully consider investment objectives, risks, charges and expenses, and should consult with a tax or legal adviser before making any investment decision.

Part 101: Analysis from 100 Methods of Prosperity Newsletters

What we’ve learned studying billionaires, so far.

Going over my 100 writings in pursuit of what traits all billionaires have.

What comes up the most?

Reputation.

Reputation refers to the beliefs or opinions that others hold about you. It’s based on your past actions, behavior, and character. It represents how you are generally regarded or perceived by others.

Key aspects of reputation include:

Perception-based. It exists in the minds of others rather than being an objective measure.

Built over time. Develops through consistent patterns of behavior and actions.

Fragile. One bad decision can ruin it. You want to rebuild your reputation? That can take a considerable amount of time.

Influential. Affects opportunities, relationships, and trust levels.

Context-dependent. May vary across different groups or situations.

Reputation can be:

Personal. An individual’s standing among peers, colleagues, or community.

Professional. How others perceive you in your career or industry.

Corporate. A company’s public image and stakeholder perception.

A good reputation leads to increased trust. You’ll attract better opportunities. You can build positive relationships. While a poor reputation can result in social or economic consequences.

We also notice the mistakes that even the brightest minds make. To think like a billionaire, we must study both their brilliance and their blunders. Here’s the blueprint for building wealth and the pitfalls to avoid along the way.

After analyzing 100 wealthy people, several consistent traits emerge. These patterns transcend time periods, industries, and personal backgrounds. You can go back to the first one here: Part 1. The Medici Family. They’re attributed with inventing the Double-entry accounting system.

They also understood the concept of leverage.

Leverage as a Fundamental Principle

Almost every figure mentioned understands that wealth creation requires disconnecting inputs from outputs:

Jakob Fugger used financial leverage through loans to nobility

Rothschilds employed leverage through international banking networks

Rockefeller leveraged market position and monopolistic practices

Gates leveraged his mother’s connections and outsourced development work

Most used debt to scale their operations

Market Inefficiency Exploitation

Successful wealth creators identify and exploit gaps in the market:

Nathan Rothschild used arbitrage during the Napoleonic Wars

Rockefeller capitalized on inefficiencies in the oil refining industry

Carnegie revolutionized steel production methods

Larry Ellison recognized the untapped potential of database software

Calculated Risk-Taking

These individuals take significant but well-considered risks:

Stephen Girard risked everything by lending to the US government

Vanderbilt risked his capital to crush competitors

Rothschilds moved capital across war-torn Europe

Warren Buffett makes researched investment decisions

4. Strategic Relationship Building

Wealth creation is rarely accomplished alone:

The Rothschilds built a family banking network across Europe

J.P. Morgan cultivated relationships with other financiers

Bill Gates leveraged his mother's connection to IBM

Buffett studied under Benjamin Graham

Most created powerful networks of allies and partners

5. Capitalizing on Distress

Many billionaires grow wealthiest during economic turmoil:

Rothschilds profited during the Napoleonic Wars

J.P. Morgan stabilized markets during financial panics

Rockefeller acquired competitors during downturns

Bernard Arnault purchased distressed assets (Boussac group)

Warren Buffett buys undervalued companies

6. Long-Term Thinking

The wealthiest people are patient with capital allocation:

Carnegie built his steel empire over decades

Rothschilds established multi-generational banking networks

Buffett holds investments for the long term

Koch expanded inherited businesses over time

7. Value Creation

Despite criticisms, most created substantial value for society:

Carnegie revolutionized steel production

Rockefeller standardized oil refining

Ford democratized automobile ownership

Gates helped create the personal computing revolution

8. Vertical Integration

Many built wealth by controlling multiple parts of their supply chain:

Ford owned everything from rubber plantations to steel mills

Rockefeller controlled oil from wells to retail

Carnegie integrated coal mines, shipping, and production

9. Wealth Preservation Strategies

The wealthy focus on keeping what they’ve built:

Rothschilds used family marriages to preserve capital

Many diversified investments (Astor shifted from fur trade to real estate)

Most created legal structures to protect assets

Several established foundations for legacy purposes

10. Business Model Scaling

Successful wealth creators identify working models. Then they execute aggressive expansion:

Fugger doubled down on his mining investments

Dutch East India Company scaled through shared ownership

Rockefeller expanded Standard Oil across the country

Gates licensed MS-DOS to multiple computer manufacturers

11. Adaptation to Changing Conditions

The wealthiest demonstrate remarkable ability to pivot:

Astor shifted from fur trading to Manhattan real estate

Vanderbilt moved from shipping to railroads

Gates transitioned Microsoft through multiple technology waves

Buffett evolved his investment approach over time

12. Personal Resilience

Wealth creation requires persistence through setbacks:

Carnegie overcame childhood poverty

Rockefeller overcame numerous business challenges

Ellison dropped out of college but continued learning

Most faced significant opposition or failures along their path

Across centuries, industries, and personal backgrounds, these traits are consistent. Which suggests they represent fundamental principles of wealth creation rather than circumstantial factors. There’s a lot of variation as far as ethical approaches. We can postulate that these core wealth-building strategies transcend individual moral frameworks.

Commonalities Among Tech and Retail Entrepreneurs

1. Resilience and Persistence

All these entrepreneurs faced significant setbacks but refused to give up:

Elon Musk faced near-bankruptcy with both SpaceX and Tesla in 2008

Sam Walton lost his first successful store when his landlord didn't renew his lease

Mark Zuckerberg weathered major lawsuits from the Winklevoss twins and Eduardo Saverin

Jensen Huang dealt with early layoffs at NVIDIA before finding success

2. First-Principles Thinking

Many approached problems by breaking them down to fundamental truths:

Elon Musk calculated from scratch how to build affordable rockets

Jeff Bezos recognized the exponential growth of the internet and applied it to retail

Google founders reimagined search engines based on link analysis. They decided to focus their attention on that rather than keyword density

Sam Walton questioned retail conventions by buying direct from manufacturers

3. Long-Term Vision

These entrepreneurs pursued ambitious goals that extended far beyond immediate profits:

Jeff Bezos focused on long-term value creation over short-term profits

Jensen Huang invested in GPU technology early on. It was long before its AI applications became apparent

Elon Musk pursued space exploration and sustainable energy as decades-long missions

Sam Walton built systems around his retail empire through gradual expansion

4. Customer-Centric Focus

A relentless focus on customer needs:

Jeff Bezos emphasized the customer above all at Amazon

Google founders prioritized search quality over cluttering with ads

Sam Walton passed savings to customers through lower prices

YouTube founders made video sharing accessible and simple

5. Disruptive Innovation

Each entrepreneur identified inefficiencies in existing systems:

PayPal Mafia revolutionized online payments

YouTube founders simplified video sharing

Sam Walton bypassed wholesalers to offer lower prices

6. Strategic Partnerships and Networks

Successful entrepreneurs leveraged relationships:

Peter Thiel invested in Facebook after connecting with Mark Zuckerberg

Reid Hoffman utilized his PayPal connections to build LinkedIn

Jensen Huang secured funding through a recommendation from his former boss

The PayPal Mafia supported each other in subsequent ventures

7. Willingness to Pivot

When original plans didn’t work, they adapted fast:

YouTube evolved from a video dating site to a general video platform

PayPal shifted from Palm Pilot payments to email-based transfers

Sam Walton moved from franchise stores to creating his own discount chain

Amazon expanded beyond books to become “the everything store”

8. Embracing Calculated Risk

All took significant risks but calculated:

Elon Musk invested all his PayPal earnings into SpaceX and Tesla

Jeff Bezos left a lucrative hedge fund job to start an online bookstore

Sam Walton used debt to expand his store network

Mark Zuckerberg dropped out of Harvard to pursue Facebook

9. Recognition of Timing

Many succeeded by identifying “why now” moments:

YouTube founders saw the convergence of affordable cameras, Flash Player, and broadband

Amazon launched when internet adoption was experiencing 2,300% growth

Google arrived when existing search engines were becoming inadequate

NVIDIA emerged when 3D graphics were becoming important for PCs

10. Focus on Execution Over Ideas

Consistent execution trumped the original idea:

Mark Zuckerberg’s implementation of social networking surpassed competitors

Sam Walton didn’t invent discount retail but executed it better than others

Google wasn’t the first search engine but delivered superior results

Amazon wasn’t the first online retailer but created the best customer experience

These commonalities suggest that success in entrepreneurship often follows recognizable patterns. This occurs regardless of industry or era.

Are you ready to distill the essence of the billionaire mindset?

What traits do these titans share, and what mistakes trip them up? Let’s uncover the blueprint to think like a billionaire. While we’re at it, we can steer clear of their pitfalls. Join me on this journey to rewire your thinking and build prosperity together.

Six Traits That Define Billionaires

Based on what I’ve observed across 100 stories of remarkable wealth-builders, here’s what they all do:

1. Master Leverage

Jakob Fugger used loans to control silver mines. Elon Musk funneled PayPal profits into SpaceX. Andrew Wilkinson scaled MetaLab with freelancers. Billionaires know leverage. That can be in terms of debt, networks, or tech. Leverage creates exponential growth.

How can you disconnect your inputs from outputs this week?

2. Seize Opportunities in Chaos

Sam Zell bought distressed assets during downturns. Nathan Mayer Rothschild profited from war-time arbitrage. Phil Knight launched Nike amidst financial struggles. Billionaires see crises as opportunities.

What distress can you turn into profit?

3. Be Relentless About Creating Value

John D. Rockefeller revolutionized oil. Sam Walton offered unbeatable prices at Walmart. Howard Schultz made Starbucks an affordable luxury. Wealth follows value creation.

What value can you create for others today?

4. Adapt and Reinvent

John Jacob Astor pivoted from furs to real estate. Richard Branson jumped from records to airlines. Andrew Wilkinson went from barista to tech mogul. Billionaires don’t cling to failure. They evolve.

What’s one thing you need to pivot from?

5. Build Powerful Networks

Mayer Amschel Rothschild stayed close to royalty. Mark Zuckerberg leveraged Peter Thiel’s investment. Larry Gagosian tapped Leo Castelli’s artist connections. Your network is your net worth.

Who can you connect with this week?

6. Stay Frugal, Be Resourceful

Sam Walton drove an old pickup truck. Phil Knight bootstrapped Blue Ribbon Sports. Andrew Wilkinson faked it ‘til he made it. Billionaires reinvest rather than overspend.

Where can you cut costs to reinvest?

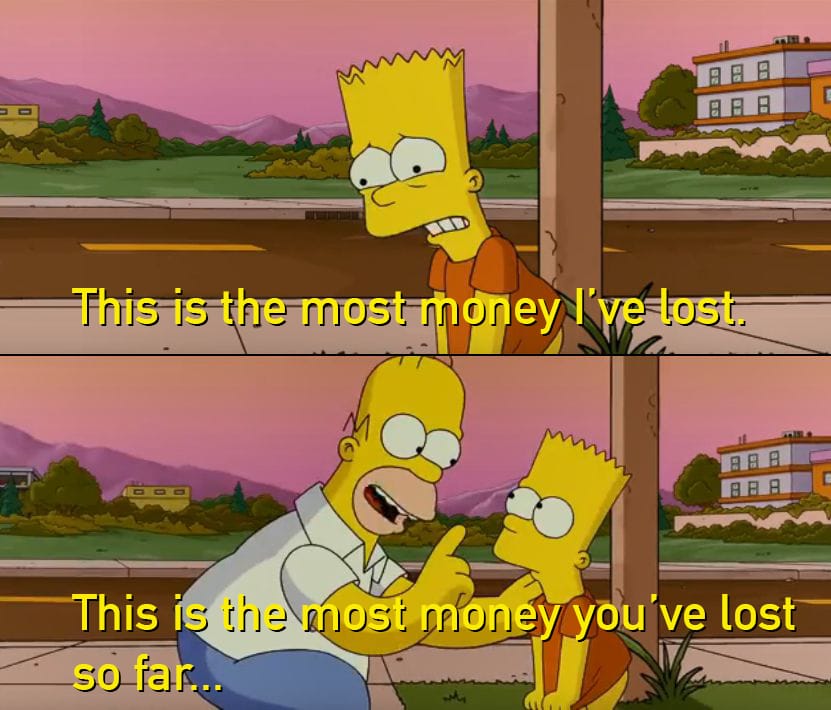

Five Mistakes Even Billionaires Make

Even the wealthiest stumble. Here’s what to avoid:

1. Overconfidence Bites Back

Andrew Wilkinson trusted a deceptive partner, and came close to losing MetaLab. Sam Zell’s Tribune acquisition led to bankruptcy. Unexpected risks can derail anyone. Stay vigilant of “Black Swans”.

2. Ethical Lapses Haunt

Richard Branson’s tax evasion led to arrest. Henry Ford’s anti-Semitism tarnished his legacy. Mark Zuckerberg faced scrutiny over Facebook’s data scandals. Guard your reputation. Shortcuts aren’t worth it.

3. Neglecting Relationships

The board of PayPal ousted Elon Musk due to team conflicts. Zuckerberg’s share dilution cost him Eduardo Saverin’s trust. Betrayal is real. Build trust with your team.

4. Failing to Diversify

Phil Knight’s reliance on Onitsuka almost sank Blue Ribbon Sports. Andrew Wilkinson struggled in 2008 without diversified income. Always maintain cash reserves and spread your risk.

5. Ignoring Broader Impact

Rockefeller’s monopoly triggered economic fallout. The Rothschilds became conspiracy targets. Understand your actions’ ripple effects. Context matters.

Your Challenge This Week

Pick one trait to lean into and one mistake to avoid. One suggestion is to focus on building your network while guarding against overconfidence. Share your plan with a friend or reply to this newsletter. I’d love to hear your thoughts. Let’s keep building prosperity together!

Until next time, think big, act smart, and stay connected.

I like you,

– Sean Allen Fenn

PS: You don’t have to follow me on 𝕏, but you can partner with me to bring about serious advancement for each other.

You can now buy the collectors edition of Methods of Prosperity newsletter number 64. It’s available to collect as of May 9, 2025. If you’re so inclined you can permanently own it!

Methods of Prosperity newsletter is intended to share ideas and build relationships. To become a billionaire, one must first be conditioned to think like a billionaire. To that agenda, this newsletter studies remarkable people in history who demonstrated what to do (and what not to do). Let me know how I can help you out. For more information about the author, please visit seanallenfenn.com/faq.

Do you know about my livestream podcast? It’s called Hidden Secrets Revealed Live (HSRL), and I record it live on 𝕏 every Wednesday.