- Methods of Prosperity

- Posts

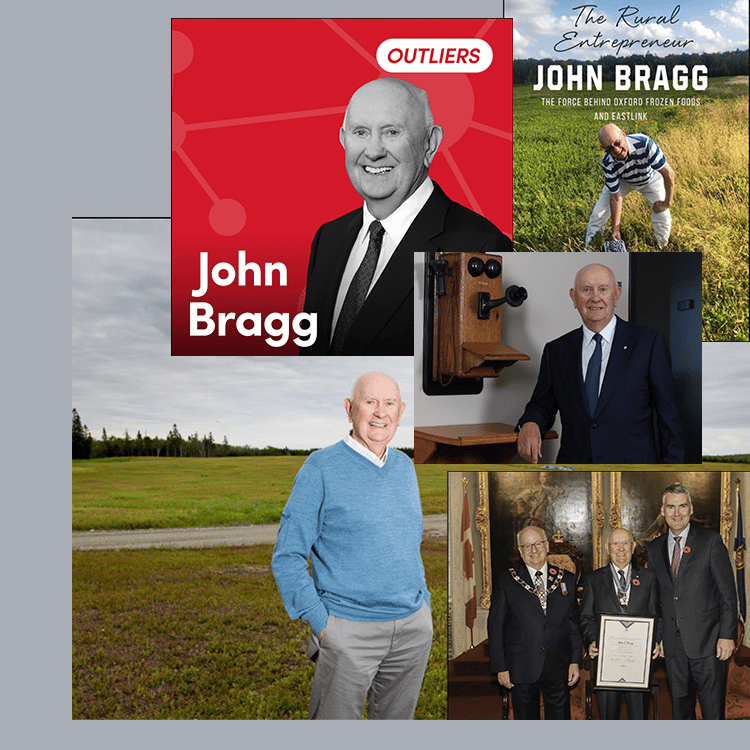

- Become a Billionaire Without Selling Unique Products —Even if it Takes 50 Years

Become a Billionaire Without Selling Unique Products —Even if it Takes 50 Years

Methods of Prosperity newsletter no. 118: John Bragg

Stick to your knitting, do what you can do and do more of it and try and grow it. Don’t try and do everything.”

Most entrepreneurs are hesitant about aggressive use of debt and leverage.

Not John Bragg, the founder of Oxford Frozen Foods. Which is the world’s largest wild blueberry processor. He’s also the founder of Eastlink. Which is one of North America’s largest privately held telecommunications companies.

He embraced debt when others shied away from it.

“We haven’t shied away from using debt... through the years we’ve always been what I would say almost fully levered... We just kept levering and levering and buying and buying some more... It was hardly a year that we didn’t have an acquisition.”

He explained why this worked: “I think that separated me from you know the original cable owners... as fiber came along and we started tying them together and there was a lot more capital involved, lots of the small town operators just decided it was time to move on that they didn't want to lever themselves the way it was required.”

John Bragg’s estimated net worth was at over $1 billion in recent years. He has received numerous honors. Which includes Officer of the Order of Canada. He’s also beed inducted into the Canadian Business Hall of Fame.

Owning a home now costs $52K more per year than renting. Families are stuck as forever renters. We’re seizing this shift. Buying 100+ unit assets in growth markets.

Few get in.

Accredited investors can gain access at Inveresta.com.

We’re improving quality of life at scale for hard working families. Inveresta.com

ⓘ This is not an offer, solicitation of an offer, to buy or sell securities. Past performance is not an indication of future results. Investing involves risk and may result in partial or total loss. Prospective investors should carefully consider investment objectives, risks, charges and expenses, and should consult with a tax or legal adviser before making any investment decision.

Most entrepreneurs avoid debt or use conservative leverage.

Not Bragg. He used strategic leverage because he thought in decades, not years:

“We were prepared to pay at the top of the cycle... if you paid a little too much and you’re a private company you just have to live a little longer to make it work... Maybe we’re paying too much but if we live long enough it’l be a good deal... Instead of a 10-year payback you took 12 and you work for nothing for 2 years and in the big scheme that was the right thing to do.”

Some entrepreneurs leverage against hope or projections.

Not Bragg.

He leveraged against predictable cash flows:

“The food business we were levered but we had good assets... but in the cable business... the cash flow was pretty consistent, you could budget it and see where you were going so I wasn’t afraid of that.”

Many business owners want to go public.

Not Bragg.

He believes that controlling a private company has its advantages.

Having a private business allows you to look at the horizon instead of looking at your feet.

According to John Bragg, “If you look at your feet you’ll stumble.”

He’s paraphrasing a Swedish diplomat named Dag Hammarskjöld:

“Never look down to test the ground before taking your next step; only he who keeps his eye fixed on the far horizon will find the right road.”

Most entrepreneurs want to differentiate their products.

Not Bragg.

Oxford Frozen Foods needed something to produce during the fall.

So his company made onion rings for McCain Foods.

Exactly like the competition.

Why?

It’s an easy sell.

You don’t want unique onion rings.

For a commodity product, you want it to be the same, or it won’t sell.

Think about it.

Tesla makes self-driving cars. They’re awesome.

But if Elon Musk announces they’re removing all brakes and steering wheels?

You’re not buying that model this year.

Would you buy a cold medicine that you need to administer by vaping, so you don’t have to take a pill?

Before you answer, it’s safe to use and not your ordinary cold medicine.

Chances are, you will avoid this kind of product like the plague. It contains too much of one ingredient: novelty.

When it comes to making a buying decision, you choose the tried-and-true.

Customers don’t take risks on exotic onion rings.

They want the same onion rings every time.

John Bragg knows this. That’s why he makes the same onion rings as his competition, only priced fair and high quality.

It’s counterintuitive for an entrepreneur. We want our product to stand out from the competition. Instead, make it plain. Only with a twist.

“Why we succeeded is we tried to find a product we could run and run the hell out of it... We’re by far the largest wild blueberry producer... So we learn how to do it and do it well and then just run it as much as we can... Don’t try and do everything.”

Let me conclude with this. John Bragg plays to his strengths:

“I’ve seen a number of friends or associates who made the first million and then thought they knew how to make the second with these [different ventures] and they would get off focus, go buy another company that they didn’t know anything about... and just not focused on what they knew.”

I like you,

– Sean Allen Fenn

PS: Notice there’s only one action for you to take. The purpose of wealth is freedom. You can have financial freedom, but not by yourself. That’s why we’re building our core group of people. It’s a community to help each other achieve financial freedom. One way is by pooling our resources to invest in Multifamily real estate together. Whatever method of prosperity you choose, don’t go at it alone. You can now join our Methods of Prosperity community on Telegram here: