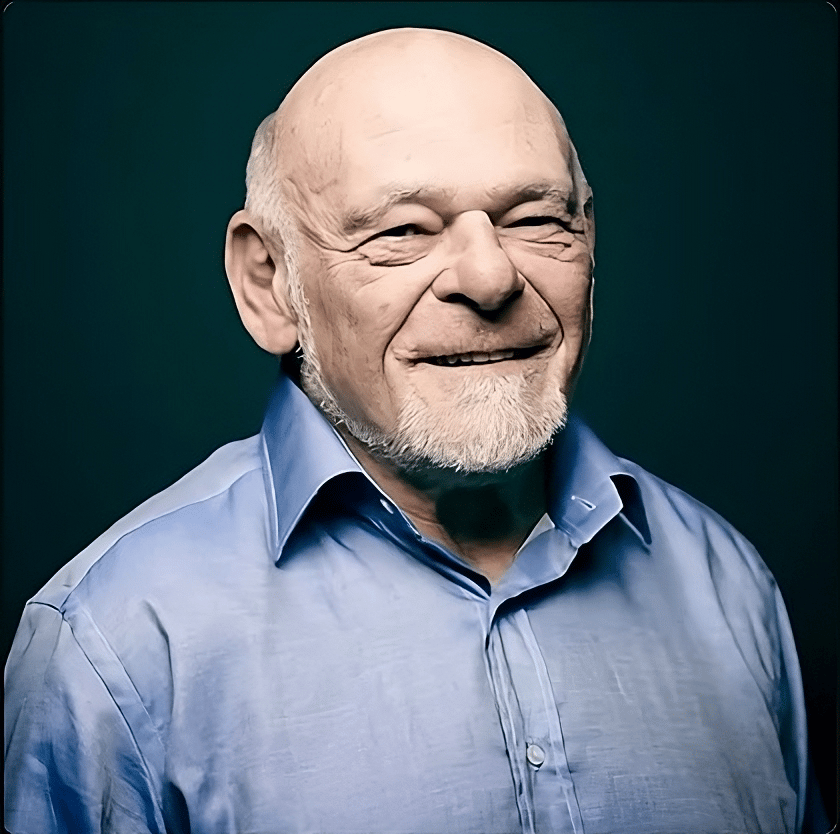

In 1966, Sam Zell graduated from the University of Michigan Law School. He struggled to find a job at a law firm. This was due to his inclination towards deal-making rather than traditional legal work. He worked at a small law firm, and soon recognized he could generate more business than they could handle. Frustrated with the limitations of working for others, Sam set up his own investment firm. He targeted small, high-growth cities. It was university towns where he achieved high returns on investments. His first acquisition was a 99-unit apartment building near the University of Toledo. That asset produced a 20% return. As his deals grew larger and more sophisticated, Sam invested with long-term people. His expertise and reputation allowed him to excel in real estate entrepreneurship. He didn’t need to work for anyone else. Until 1969, when someone would offer him a job that would impact his career.

Do you know I’m a musician? My new holiday single drops soon. Onchain first, and then streaming.

Part 78. Sam Zell (continued).

ⓘ We’re improving quality of life at scale for hard working families.

Inveresta Holdings LLC is seeking capital partners, brokers, and motivated sellers. You’re invited to secure your place on our waitlist now. You’ll receive details about our investment strategy. This is not an offer, solicitation of an offer, for anything at this time. All investments have risk. Past performance is not indicative of future results. Always do your own research.

Key Lessons:

Be the kind of person you want to attract.

The deal’s not done until it’s done.

Buy assets that have cash flow.

Why work for someone else?

The IRS is not your friend.

Supply and demand.

Risk and reward.

Now there’s a collectible version of this newsletter! Methods of Prosperity newsletter number 41 is available to collect as of December 6, 2024. If you’re so inclined you can permanently own it!

It was 1969. Sam and his business partner had been getting above average returns from their Reno deal. Reno was growing, and the building they owned there was at 100 percent occupancy. It was returning 19 percent cash-on-cash. That means it was generating great cash flow from cash invested. Life was good and about to get better.

One morning, Sam received a call from his broker friend. He called to tell Sam about Jay Pritzker. Sam knew who he was. Everyone in Chicago knew who he was. Jay Pritzker was a prominent entrepreneur. He bought the Hyatt House motel in 1957. He co-founded the Hyatt Hotels Corporation and the Marmon Group. He expanded the Hyatt brand globally. His liquidity and connections made him the go-to guy of his era. He was legendary in the investment world.

Sam’s friend learned that Pritzker was looking to hire a successful lawyer under 30 to come work for him. Sam’s broker friend immediately thought of him. Which was intriguing, but led to a conundrum. Sam considered the idea. He was already a successful real estate entrepreneur and attorney. Why would he want to work for Pritzker, or anyone else?

Sam’s broker friend suggested that he needed to meet Jay Pritzker. The next morning, Sam Zell met Jay Pritzker at nine o’clock. He sat in Jay’s office as he took calls and they discussed various deals. At lunch, Jay gave Sam the full sales pitch. “You could come here and do deals,” he offered. Sam would earn five percent. Only five percent? Sam quipped, “Oh, so that’s a Pritzker deal.” Jay Pritzker was serious. Sam and Jay kept talking. Sam knew he wouldn’t take the job, but didn’t leave his office until four thirty that afternoon.

At the end of the day, Sam told Jay: “I’m not going to work for you or anyone else. Why don’t we do a deal together?” Jay agreed. Sam had a loan on a property in Lake Tahoe. Sam offered Jay the opportunity to buy and develop the site together. Jay agreed. That meeting was the most influential relationship of Sam’s career. That is, apart from the ones with his father and Bob Lurie.

“Jay was the smartest financial guy I’ve ever met. He taught me how to look at deals. How to focus on what would either make them or break them. He introduced me to new ways of looking at opportunities and transactions. He became my mentor and my friend.”

This project in Tahoe would be Sam’s second attempt at developing a property from scratch. After his four day stint as an attorney, he decided to go back to buying existing properties. In addition, why not become a developer? His idea was to build the General Motors of the housing industry.

For the Tahoe project, Sam would bring in prefabricated homes. The weather permitted a few months when trucks could bring them in. After the builders assembled the project, Sam discovered a problem. The contractor extended the eaves too long past the windows. Instead of beautiful mountain views, the windows looked out to the inside of the roof. He solved the problem by having the contractors cut windows into the roof to save the views. It was a debacle.

Sam’s project in Kentucky had problems as well. The apartments were 80 percent completed when Sam discovered the next debacle. The builder had built to incorrect specifications, making the units lopsided. They were too far along to correct it. Sam ended up renting the small units for less than the large units.

It turned out that development was more complex and risky than Sam expected. Not only can blueprints have errors, but city regulators can interrupt the project. They can charge new fees and hidden costs. The economy can shift, causing tenant demand to evaporate. During the time it takes to build, banks can pull the rug out from under you. The upside is not worth the downside. Sam changed his mind about becoming a developer.

They liquidated the Tahoe property years later. Sam realized that he and Jay never formalized their partnership agreement. What if the IRS comes around (which they would)? Jay wasn’t worried. Sam and Jay had complete trust in each other. Jay taught Sam how to understand risk. Jay identified the one linchpin factor that moved the needle. He taught Sam how to chunk down a problem into all its parts. That’s thinking from first principles.

In 1970, Sam and Jay acquired Broadway Plaza in Los Angeles. It was the end of the year and the deal had to close for tax considerations. The seller was flirting with other buyers. Sam and Jay met with lawyers in a meeting that lasted 48 hours to finalize. It was intense and exhausting.

In January 1971, Jay had a heart attack during their ski trip. He survived and was back in business two months later. Sam and Jay kept on doing deals together until 1999, when Jay died of heart trouble. Jay Pritzker was 76 years old.

In 1969, Bob Lurie liquidated his property management business in Ann Arbor. He joined Sam in Chicago. They made an amorphous agreement. At first their partnership was 85/15. By 1974, it was 66/33. By 1976, it was 60/40. By 1978, it was 50/50. They never had a written partnership agreement. They had complete trust in each other. Bob was analytical and Sam was instinctive. They complemented each other. Bob had a talent for boiling down an idea to its essence.

Bob managed their Reno assets for the first two years of their partnership. While he was there, the engineer’s union tried to unionize one of their buildings. It only had 13 employees, and Bob knew each one of them. He believed they wouldn’t vote for the union. It was a fait accompli. He was wrong. It was unanimous. The union won. That was a lesson Sam and Bob would never forget. The deal’s not done until it’s done.

Bob returned to Chicago in 1971, when they moved into a larger office space. Their investment firm, Equity Growth Investments (EGI) was growing. They formed a meritocracy. It wasn’t hierarchal. They paid staff a salary, but the real money was in the deal residuals. They helped each other succeed. They dressed casual, which was unheard of in 1970s finance. Sam claims they invented business casual.

In the beginning, they reinvested their residual equity back into the business. EGI was asset rich and cash poor. They bought a lot of real estate in the 1970s. They earned the reputation of speed and certainty for winning deals. In 1974, Sam started doing business with a man named Arthur G. Cohen, a prominent figure in real estate. He co-founded Arlen Realty & Development Corporation in 1959 with Arthur N. Levien. Arlen managed over 42 million square feet of commercial space by 1975. Arthur’s properties became over-leveraged. He had a habit of kicking the can down the road until the next market crisis. Then he would renegotiate his loans.

Arlen Realty had acquired an offshore real estate mutual fund. It offered investors daily redemption of long term assets. The market softened in the 1970s. Those redemptions put enormous pressure on Arlen Realty for cash. Arthur’s non-stop ability to go from deal to deal putting out fires amazed Sam. Sam and Bob stepped in to acquire distressed properties from Arlen Realty. In 1976, they acquired a high rise hotel and apartment complex in Reno. Negotiations had gone on for a year. The sticking point was a typical situation. The gap between the price Sam was willing to pay and the price the owner was willing to sell. The tax bill was too high, but Sam wanted to make it work. So he took it to his brother-law’s law firm. They conjured up a convoluted tax structure for the sale. It never occurred to Sam that it would attract investigation from the IRS.

To be continued...

I like you,

– Sean Allen Fenn

Methods of Prosperity newsletter is intended to share ideas and build relationships. To become a billionaire, one must first be conditioned to think like a billionaire. To that agenda, this newsletter studies remarkable people in history who demonstrated what to do (and what not to do). Your feedback is welcome. For more information about the author, please visit seanallenfenn.com/faq.

Now you can join our SelfActualizer community. Learn more here.