“Risk is the ultimate differentiator.”

Methods of Prosperity newsletter is intended to share ideas and build relationships. To become a billionaire, one must first be conditioned to think like a billionaire. To that agenda, this newsletter studies remarkable people in history who demonstrated what to do (and what not to do). Your feedback is welcome. For more information about the author, please visit seanallenfenn.com/faq.

In the early 1990s, the commercial real estate market experienced a severe downturn. The collapse of the savings and loan industry had something to do with it. This led to plummeting property values and substantial investor losses. Sam Zell and Merrill Lynch capitalized on this crisis. They acquired discounted assets, raising $2.1 billion across four funds.

The market began recovering in the mid-1990s. The Fed lowered interest rates. The US government had to bail out the savings-and-loan industry in 1989. They passed the Financial Institutions Recovery, Reform and Enhancement Act (FIRREA). That legislation established the Resolution Trust Corp. (RTC). The RTC sold off assets at a fraction of their assessed values.

The dot-com boom turned into a bubble in the late 1990s. Rapid growth and speculative investments in internet-based companies culminated in a market frenzy. The bubble burst with a market top in March, 2000.

Zell built a significant real estate portfolio during that era. He established major REITs including Equity Residential and Equity Office Properties. The latter became the largest office building manager in the US. It was too big to sell. That was his misconception. After some unexpected offers in 2005, he realized it wasn’t.

Do you know about my livestream podcast? It’s called Hidden Secrets Revealed Live (HSRL), and I record it live on 𝕏 every Wednesday.

Part 84. Sam Zell (continued).

Sam Zell, Methods of Prosperity 84.

ⓘ We’re improving quality of life at scale for hard working families.

Inveresta Holdings LLC is seeking capital partners, brokers, and motivated sellers. You’re invited to secure your place on our waitlist now. You’ll receive details about our investment strategy. This is not an offer, solicitation of an offer, to buy or sell securities. Past performance is not an indication of future results. Investing involves risk and may result in partial or total loss. Prospective investors should carefully consider investment objectives, risks, charges and expenses, and should consult with a tax or legal adviser before making any investment decision.

Key Lessons:

Beware of genetic, or “hometown” bias.

Beware of operational risk.

Beware of the Black Swan.

Calculate downside risk.

Don’t be a target.

Negotiate hard.

Keep it simple.

Now there’s a collectible version of this newsletter! Methods of Prosperity newsletter number 47 is available to collect as of January 19, 2025. If you’re so inclined you can permanently own it!

It was peak market timing before the 2008 financial crisis. In 2007, Equity Office Properties Trust (EOP) was the largest REIT in the USA. Sam Zell’s primary obligation was to his shareholders. He owed them the fiduciary responsibility to give them the best return possible. He backed up that commitment as the largest shareholder. He thought EOP was too big to sell.

Several unsolicited offers corrected Sam’s misconception, starting in November of 2005. A bid came in for from the California Public Employees Retirement System (CalPERS). It was for $25 billion. It was too low for Sam to consider. Blackstone approached them with an offer of $42 per share in August of 2005.

Blackstone Group announced its plan to acquire EOP on November 19, 2006. The deal was initially valued at approximately $36 billion. Blackstone offered $48.50 per share in cash for all outstanding common stock of EOP. It added up to a total of $36 billion. Sam insisted on a small breakup fee, around 1% equity value, to attract more bidders. To increase his leverage, Sam Zell enforced other terms. Terms included an NDA. This prevented them from pre-arranging sales of the portfolio ahead of time.

Sam viewed this $36 billion as a floor for more offers. This acquisition was the largest-ever acquisition of a REIT at the time. A bidding war broke out for EOP. Vornado Realty Trust made a $45.00 per share offer for EOP in early November 2006. Blackstone Group followed up with a counter-offer of $48.50 per share later that month. Voronado came back with a bid worth around $54.81–$55.07 per share. After some back-and-forth, Blackstone won the bidding war. Blackstone increased its offer to $55.50 per share for EOP’s Class A units. Valuation increased to $39 billion including debt and equity. They finalized the deal on February 6, 2007. EOP shareholders approved the transaction.

It’s easy to get excited about the upside. Everybody wants to find a good deal. Sam was always looking for unlocked potential. Strong fundamentals, a high probability of success is exciting. You want to know how good a deal can get. What less people want to do is focus on the downside. It’s amazing how superficial other people are at that. For Sam Zell, the calculation of a deal starts with the downside. Identify your downside risk, and you can understand the risk you’re taking. What’s the outcome if everything goes wrong? What actions will you take to mitigate risk? Can you afford to lose it all?

In the 1990s, Sam Zell's company owned Carter Hawley Hale Stores, Inc. (CHH). CHH was one of the largest department store chains on the West Coast. They operated under various names including The Broadway, Emporium, and Weinstock’s. CHH was Zell/Chilmark Fund’s first acquisition. They also owned Walden Books and Neiman Markus. At its peak in 1984, CHH was the sixth largest department store chain in the USA. CHH filed for Chapter 11 bankruptcy protection in February 1991. This was due to financial difficulties exacerbated by a leveraged buyout in 1987. The global financial crisis didn’t help, either. Zell/Chilmark Fund acquired a significant stake in CHH during its bankruptcy proceedings.

Zell knew their downside risk going into it. The most his team would lose if the deal goes south, he calculated, was 20%. They bought around $550 million in bonds and trade claims for 47¢ on the dollar. Which equated to around $220 million. Those claims would convert into stock when CHH emerged from bankruptcy. Zell gained control over the company by 1992, over 70% of the equity. He owned CHH for 3 years, during which time, business was bad. Natural disasters and civil unrest didn’t make business any better. Earthquakes, riots and fires hit California stores. “It was like the ten plagues,” Sam recalled. Revenues plummeted. Federated department stores acquired CHH in 1995 for 80% of Zell’s purchase price. Zell lost around $50 million, 20% of his investment. His risk analysis was exactly right.

The other major risk to watch out for is operational risk, or how difficult a project is to execute. It can’t be too complicated. On a personal note, a potential investor turned down a deal we were looking at. He said it had “too many moving parts”. I’m sure he meant there was too much operational risk. He was right. Once I looked closer at the market comparison data, it turns out that deal had more risk than that.

Known risk is one thing. Let’s talk about unknown risk. Remember newsletter number 76, Sam Zell Discovers the Black Swan? The real Black Swan event was September 11, 2001. Sam Zell owned American Classic Voyages, which purchased American Hawaii Cruises. Sam described the cruise ships as “floating hotels”. They were expensive to build and refurbish. His business plan was to refurbish their fleet of 240 ships, and build 2 new ones. The new ships would be the first built in the USA since the 1950s. Congress secured the loans. A shipyard in Mississippi won the contract. By late 2002, the first ship would be in service, and the second one would be 2004. They expected a great decade of growth. American Classic Voyages filed for bankruptcy in October 2001. The cessation of operations for American Hawaii Cruises occurred shortly thereafter.

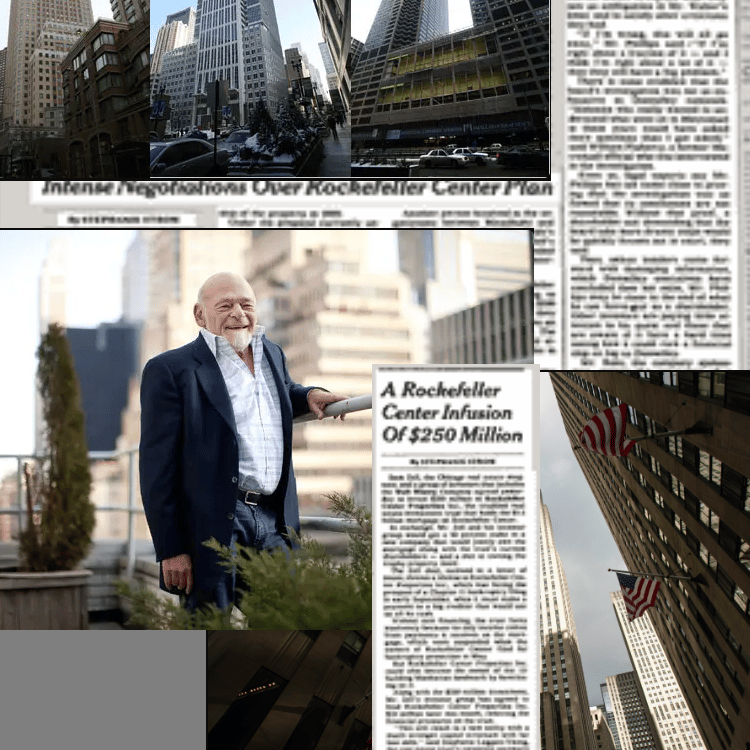

In 2000, Sam had the opportunity to bid on the World Trade Center. The Port Authority of New York put the WTC lease up for bid when Zell’s EOP was the largest REIT in the USA. They were on top of the list. Sam had already experienced the “hometown” effect. That’s the reaction an outsider gets when attempting to buy a big building in another town. Sam Zell attempted to acquire Rockefeller Center in 1995. In August 1995, an investment group led by Zell, agreed to invest $250 million. This group included Walt Disney Co. It was a big effort to gain control of the landmark Manhattan property. Rockefeller Center’s owners had filed for bankruptcy protection earlier that year. A bidding war ensued. In November 1995, a group led by investment banking firm Goldman Sachs & Co won the bid. The Goldman Sachs-led consortium included David Rockefeller. They won the bidding with a $306 million cash offer for Rockefeller Center Properties Inc.

Sam knew the WTC deal would result in a similar outcome. Sam Zell was from Chicago. New Yorkers resist selling their landmarks to outsiders. Sam warned the CEO of his company that this was another “hometown” deal. The effort to win it would be massive, with a small probability of winning. He also mentioned that he didn’t want to own a target. Larry Silverstein won the bid, and signed the lease for the WTC in July 2001.

The reason I write this newsletter is to analyze what billionaires do, and try to grasp their mindset. We notice what they do right and what they do wrong. Sam was wise, but he wasn’t perfect. It was the beginning of the information age. The dot-com bubble had burst, and Sam ignored the technology. Imagine buying a big newspaper when the internet was about to disrupt the business. In 2006, a 159 year old media conglomerate was looking for a buyer.

To be continued…

I like you,

– Sean Allen Fenn

Now you can join our SelfActualizer community. Learn more here.